What do consumers look at when opening a current account?

In February 2016 WUA! carried out a study of the orientation behaviour of consumers looking for a current account, ING.nl was the winner of this study (article in Dutch). In this study, 200 respondents on their desktops and 200 respondents on their smartphones searched for a new current account. This article focuses on the results of the desktop study.

The results of the research show: the 4 major banks dominate. With 83 points, ING.nl gets first place, only one point ahead of Rabobank.nl. ABNAMRO.nl finishes third with 77 points. SNSBank.nl got fourth place (75 points). The smaller providers follow in 5th to 8th place. The main reason for this is the fact that these brands are less well-known. Whilst on average 77% of respondents manage to find the 4 major banks, ASNBank.nl, Triodos.nl, Knab.nl, and Regiobank.nl have to make do with 26%. The top 4 takes a huge chunk of the first choice in the market (73%). For their studies, WUA! use the validated Web Performance Model to map the performance of websites. This is done based on the three main topics Look & Feel, Offerings, and Brand.

This article focuses on a best practice that emerged from the study for each of the themes.

Look&Feel: Ensure that the most important information is immediately visible

Whether a website gets a good or less good score on the topic of Look & Feel depends on a number of factors. First of all, a website needs to function 100% properly in a technical sense. Further, the navigation and design should have a supporting function in the customer journey: website visitors should be able to easily find their way, with a clear, logical presentation of images and text.

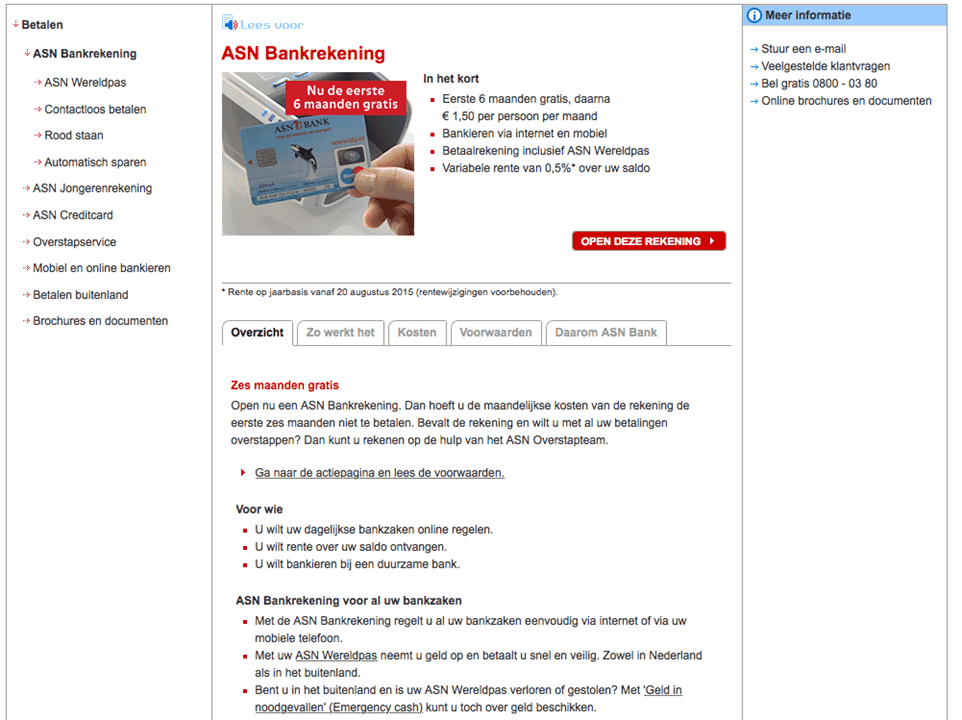

In addition to the technical functionality, navigation, and design, the provision of information is crucial. Websites should provide error-free, accurate, complete, and current information. On this last aspect – information provision – ASNBank.nl performs really well in this study. Respondents note that they can quickly find the most important information on ASNBank.nl, and that it is objective and honest. One respondent noted the following: “A beautiful site, where you can easily find all the information under one tab.”.

Respondents are also positive about the clear way in which ASNBank.nl provides information about the monthly costs of the ASN Bank Account. The bank does this using an attractive offer (“six months free”), but also by being very clear about the monthly costs afterwards (“€1.50 per person per month”). Respondents really appreciate this clarity.

Screenshot ASNBank.nl

Offerings: Help visitors of your website make choices

When evaluating the offerings, price is an important variable. The monthly costs of a current account shouldn’t be too high, of course. In addition to price, other things play a role. For example, it’s important that the offerings are explained as clearly as possible, and that a current account meets the respondents’ individual needs and requirements as closely as possible.

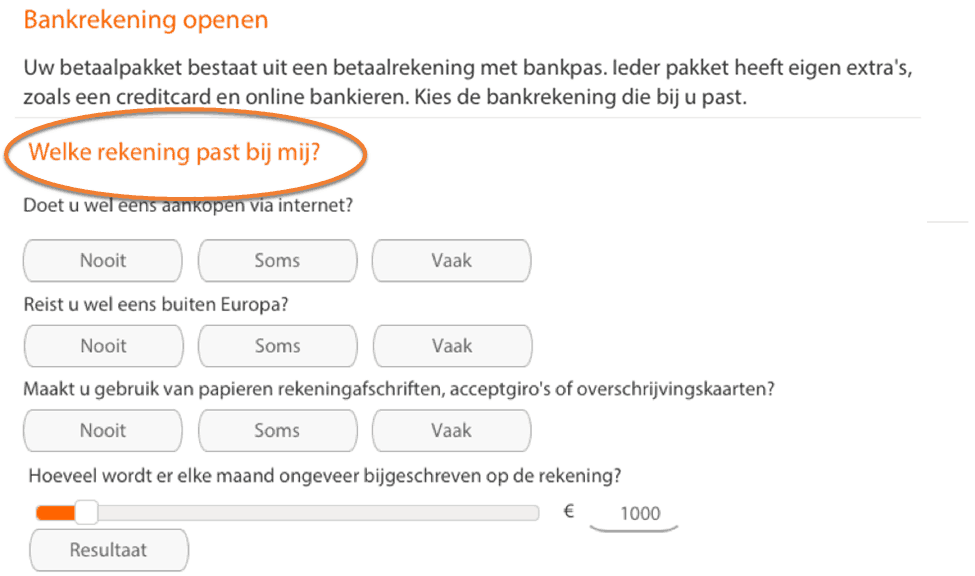

In this study, Rabobank.nl scores very well on the topic of Offerings. The bank does this by not only offering a wide range of options, but also by presenting the different current accounts as clearly and personal as possible. The latter is achieved through a convenient and clear tool. Respondents are given a series of questions, and based on their answers, Rabobank.nl advises which current account best matches their personal situation. The following statements show that respondents are satisfied with this:

“You can choose exactly what works for you, so there are no needless fees and charges.”

“Plenty of choice, they help you make a choice by asking questions.”

Screenshot Rabobank.nl

Brand: Clearly indicate what you stand for as a company

A clear website (Look & Feel) and attractive prices (Offerings) alone aren’t enough to score high in this WUA! study. It is also important that respondents have a clear picture of the company behind the website (Brand).

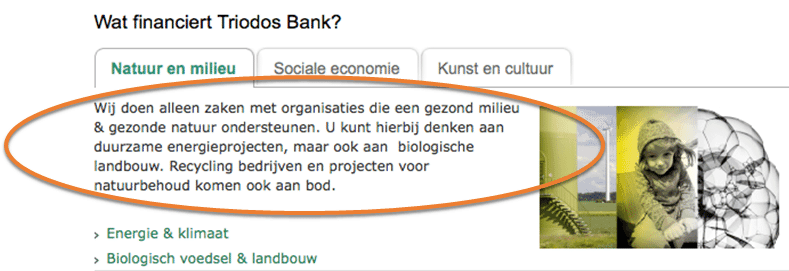

Is the company reliable? Knowledgeable? Professional? Likeable? These things contribute to a positive brand experience, and are crucial for the trust respondents may or may not have in the brand. ASNBank.nl and Triodos.nl do well in this study when it comes to the faith respondents have in the companies and the confidence people have in the promises of these banks. The sustainability pursued by both banks, and the way in which know how to present this on their website, are much appreciated by respondents:

- “Respect for people and nature, there’s more to it than just making a profit.” (ASNBank.nl)

- “This company thinks about the world around us.” (ASNBank.nl)

- “Sustainable investment, and being open about it to everyone. A transparent policy.” (Triodos.nl)

- “It is a bank that makes more sustainable investments than other banks, and it radiates this.” (Triodos.nl)

Screenshot Triodos.nl