Lessons learned from a misunderstood product

Life insurance definitely isn’t the simplest of insurance products. But fewer people refrain from shopping around for it online and, if possible, applying for the product. A recent WUA! study conducted in The Netherlands shows that the difference between life insurance and funeral insurance is often very unclear to consumers, and sometimes these two products are even confused!

In this best practice you’ll find a few tips with regard to offering more complex products online.

1 Define the product well

What exactly is the difference between life insurance and funeral insurance? When do you take out which product? And what does annuity mean? For people who deal with the material a daily basis it is almost inconceivable that someone might confuse life insurance and funeral insurance. Yet for the average Dutch consumer it’s not a piece of cake.

Important lesson: When two or more products can cause confusion, a clear explanation is essential. So explain in a clear fashion what product you are offering, and explain that you are not talking about insurance X. If both products are offered on the site, it is necessary to clearly explain both products separately. It is also important to always be aware of the perceived complexity and potential confusion that consumers may experience. A microwave or a children’s bike require less explanation than life insurance, which is often linked to a mortgage as well.

Source: Zwitserleven.nl

Source: CentraalBeheer.nl

2 Offer a helping hand

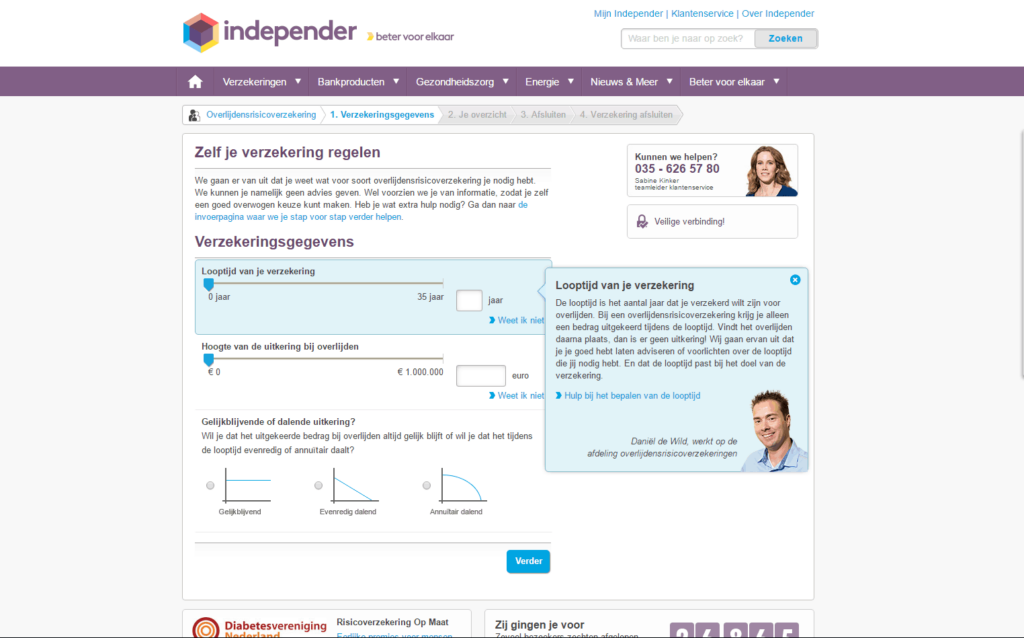

Independer.nl likes to offer visitors a helping hand when answering questions related to calculating a premium for a life insurance policy. Independer.nl takes the time to help visitors with difficult questions. This way, uncertainty is removed, and the visitor knows exactly what they are getting, and it motivates them to continue online.

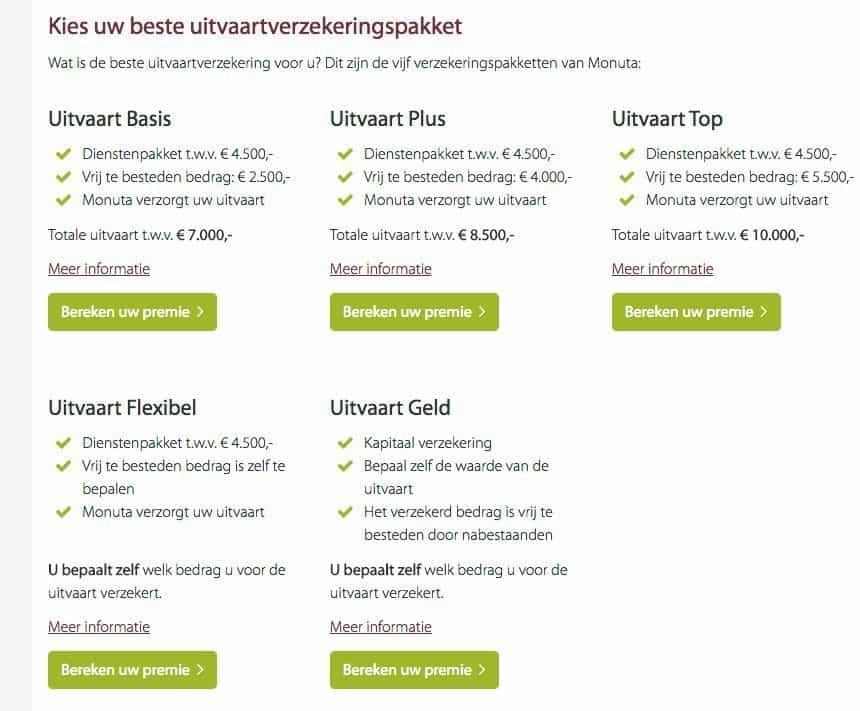

3 Make comparison possible

When searching for a life insurance policy, people often visit the website of Monuta, even though this party doesn’t offer life insurance. Often, the confusion already begins with Google: when people enter the Dutch word ‘overlijdensverzekering’, which literally means ‘death cover’, they could end up with results that include parties that offer life insurance, but also parties that only offer funeral insurance, like Monuta. Yet life insurance providers can learn from Monuta, because this provider excels at giving an overview of their offerings by putting different packages next to one another. Visitors can easily make a choice based on their own comparison.

Conclusion

The average consumer doesn’t have an overview of all life insurance offerings, let alone products that are in some way related. The example of Monuta, where people initially believe they are looking at life insurance policies, says it all. Organizations in the insurance industry would benefit from continuously approaching the content of their websites from the consumer’s perspective. Keep asking yourself ‘Are we really explaining the products clearly enough when we look at them from a broader perspective? Do we know more than what A/B testing, usability tests, and research among our own employees have shown?’.