Private Lease study in 3 countries with 1,200 respondents: Observations and learnings from the UK, the US, and The Netherlands

Recently, WUA carried out an independent digital experience benchmark study of the private lease market in The Netherlands, United Kingdom, and United States, with 1,200 carefully selected respondents who were asked to go online to orientate themselves on a private lease car using their desktop computer or smartphone.

Our Digital Sales Scan is based on our validated Digital Sales Model with a proven predictive value higher than 70%. This article highlights the differences between these three countries when it comes to consumers’ digital experiences during their orientation process, and what we can learn from the results in these different countries.

Brand websites popular in the US

Our first observation is that in the United Kingdom, private lease dealers outperform manufacturer websites, whereas in the United States, brands perform as well as, if not better than, websites focused on a multi-brand offer.

UK respondents mentioned that they value an extensive product range, which is reflected in the high scores of AutoTrader.co.uk (which offers over 441,000 vehicles) and Nationwidevehiclecontracts.co.uk (which has more than 380 different models on offer) on the Product Offer customer experience theme.

Plenty of opportunity to create a clear winner in UK and US

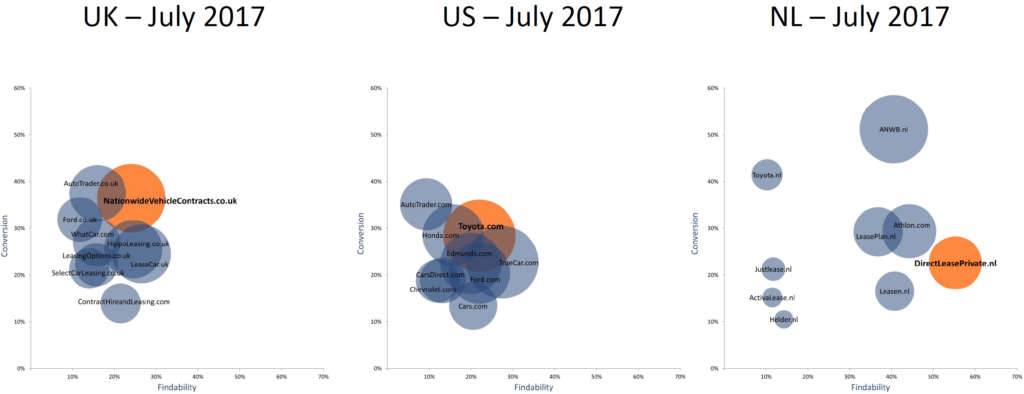

The graphs below show that, unlike in The Netherlands, the ‘winner takes all’ principle doesn’t quite hold in the in the United Kingdom and the United States – yet. The providers are relatively close to one another. We usually observe a clear leader – in private lease, but also in other markets. This is not the case here. The fact that there currently is no clear winner means that there is an opportunity to create one in the future!

Another observation is that the United Kingdom and The Netherlands perform better on mobile than the United States does. Our analysis shows that slower loading times in the US may be one of the causes.

Findability and conversion much higher in The Netherlands

The most important first step in the sales funnel is that your target audience reaches your website. In the United Kingdom and the United States, there are no strong winners when it comes to findability. In these countries, the private lease providers have a much lower findability than in The Netherlands. LeaseCar.uk has the highest findability in the UK market (27%) and TrueCar.com is found the most in the US (28%), whereas the highest findability in The Netherlands lies at 55% for DirectLeasePrivate.nl. The reason for these differences is not necessarily the fact that the Dutch market is smaller than the US and UK markets: Our car insurance study in the UK shows a findability of 55% to 59% for the top 3 players in that market, and they are far ahead of the other providers in terms of findability.

Similarly, the top conversion rate in The Netherlands (53% for ANWB.nl) is much higher than the top conversion rates in the UK and the US markets. Again, our car insurance study in the UK also shows a top conversion rate of 51% followed by a large gap, which indicates that it is not necessarily related to the country, but rather to factors within the market itself. In the Unites States, AutoTrader.com has the highest conversion (38%) but the lowest overall findability (9%). A similar pattern emerges for its UK counterpart AutoTrader.co.uk, which has the highest conversion in the UK market (38%) with a relatively low findability of 16%. Therefore, it is important for AutoTrader to improve their findability in both countries in order to increase their market share.

Paid search results less important in the UK

In the UK, almost all respondents enter the websites via a search engine. In the US, the search engine is also the most used method to visit the websites, but to a lesser extent than in the UK and The Netherlands.

Paid search results play a less important role in the UK than in The Netherlands. Only Nationwidevehiclecontracts.co.uk, LeasingOptions.co.uk, and AutoTrader.co.uk get more than half their visitors through sponsored links. In the United Kingdom, ContractHireandLeasing.com has the second highest findability on desktop, where it gets 97% of its search engine traffic organically. In the United States, paid search results play a larger role than in the United Kingdom, similar to The Netherlands.

Preference much higher in The Netherlands

The highest preference lies at 21% in The Netherlands (ANWB.nl), whereas in the UK and the US, the highest overall preference is 9% (Nationwidevehiclecontracts.co.uk) and 6% (Toyota.com and TrueCar.com) respectively. Considering the fact that the UK and especially the US have a much higher population than The Netherlands, these providers get much more preference in absolute numbers.

UK performs well in the First Impression phase…

In the First Impression phase, AutoTrader.co.uk scores 3 to 4 points higher on Product Offer than the highest scoring providers in the US (Toyota.com) and The Netherlands (Justlease.nl). When it comes to Look & Feel, AutoTrader.co.uk also manages to outperform the highest scoring US provider Ford.com and NL provider Justlease.nl. When it comes to Brand, Dutch provider ANWB.nl comes out on top, scoring 5 points higher than the best UK (AutoTrader.co.uk) and US (Ford.com) brands.

…US performs well in the Further Look phase

In the Further Look phase, the US providers tend to get higher scores on the customer experience themes than in The Netherlands and the UK. There is a 6-point difference on Product Offer between the highest scoring Dutch provider Justlease.nl (79 points) and the highest scoring US provider Honda.com (85 points), and a 3-point difference on Brand between the highest scoring UK provider AutoTrader.com (83 points) and the highest scoring US provider Honda.com (85 points).

What have we learned?

Cut the crap. UK respondents indicated that they like to be able to get to the point quickly. They prefer a clear, well-presented overview of the product offer that doesn’t contain a lot of unnecessary or irrelevant information, but enough information in order to quickly decide whether the website has a suitable offer for them. US provider Toyota.com has a useful tool to quickly browse its entire product range, right on the homepage, and Ford.com offers filters that can be easily collapsed or removed.

Help people choose. US consumers are positive about the way in which Toyota.com allows visitors to compare and easily swap up to three different cars, which can be compared based on all their specifications and features. UK consumers rate AutoTrader.co.uk for its two types of reviews: customer reviews, and expert reviews. These two variants help potential customers make a decision based on previous experiences of other customers, as well as the knowledge and expertise of the company behind the website.

Remove doubts. In all three countries, the providers that receive good scores on Brand have in common that they provide clear USPs that help convince the visitor that they are in the right place for a private lease car, and that they are in good hands. They offer clear contact details and various ways in which the company can be contacted.

Product Offer varies between countries. In the Netherlands, the lease offer differentiates substantially through packaging insurance, roadside assistance, and service costs. This private lease segment has only recently started to grow in The Netherlands. Given the offer, we expect it to continue booming.

To beat the competition, you have to offer an excellent digital experience

This study shows once again that Digital Excellence is an absolute necessity. To beat the competition, you have to offer an excellent digital experience in the entire customer journey, and take the number 1 position when it comes to preference. Being found and scoring high in Google isn’t enough.

WUA can give you insights to increase your conversion and beat the competition

In the study, WUA’s online experts reveal problem areas and areas for improvement for all customer experience themes, based on the Digital Sales Model.

We offer conclusions and concrete recommendations to a limited number of providers in a tailored report. Who can benefit from this study?

- Everyone who is commercially responsible: The winner takes it all.

- Management: For the right direction and mindset.

- Online marketing professionals: Get started immediately with the recommendations for higher conversion.

- Research: Thorough research with validated model is the foundation for digital success.

- Proposition/marketing: In addition to Look & Feel, the themes Product Offer and Brand are key factors in the purchasing process.

Would you like more insights into the private lease market? We have a crystal-clear image of your position and results.