finance

Lead the way in Finance

Stay one step ahead of the competition with continuous strategic insights and increase your market share in the finance industry.

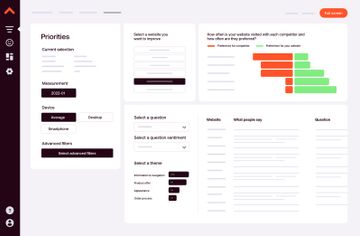

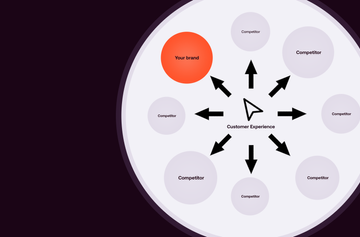

Get ahead of your competitors

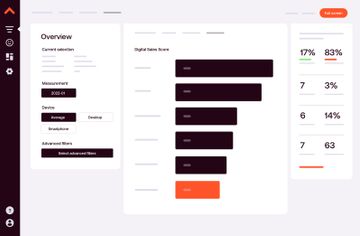

Serve your customers better than the competition can. WUA empowers you with clear insights and priorities, keeping your teams aligned and on track to outsmart the competition at every step. Use our clear KPIs and focus resources on only the priorities with the greatest impact.

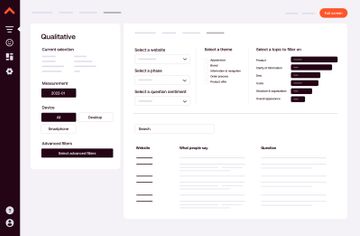

Know exactly what motivates your customer

Get the inside scoop on their needs when the customer decides to take out a mortgage, credit card, or personal loan – and why they choose a competitor instead of you. Get in-depth and qualitative research about consumer needs and the triggers that lead to a buying decision.

Stop making blind assumptions

Your tailored dashboard will give you an edge you never had before. Know exactly what your customer wants – and why. Retain your customers with a digital customer experience that measurably fulfills their needs. Make sure they can always find the financial product or service they’re looking for – easily.