This one tip can help any auto insurance company convince more drivers online

Every driver has to fill in a boatload of personal information before they can get an auto insurance quote online. The process always begins with basic questions about things like name and zipcode, and before you know it you’re estimating how many miles you drive in a year. It’s a tedious process, one that’s become standard across the websites of all car insurance companies in the US.

In our previous best practice article for the online car insurance market, we highlighted a couple ways in which insurance companies can distinguish themselves from the competition during the quote-getting process. This time around, we’re going to explore something that car insurance companies must not overlook: the quote proposal page, the one that’s displayed to customers after they’ve provided all their personal information.

Reward the customer for their efforts

Drivers want to know TWO things once they’ve entrusted the insurance company with their information: how much their insurance policy will cost them and how much damage it will cover. And that’s exactly what the car insurance company should give them. Immediately. If the customer is going to take upwards of 10 minutes out of their day to provide all that information, they should be rewarded for their efforts. Insurance companies take different approaches for proposing insurance to the customer after receiving their information, and the data from our ongoing online car insurance benchmark study shows some ways work much better than others. Let’s first take a look at what you shouldn’t do.

What you shouldn’t do

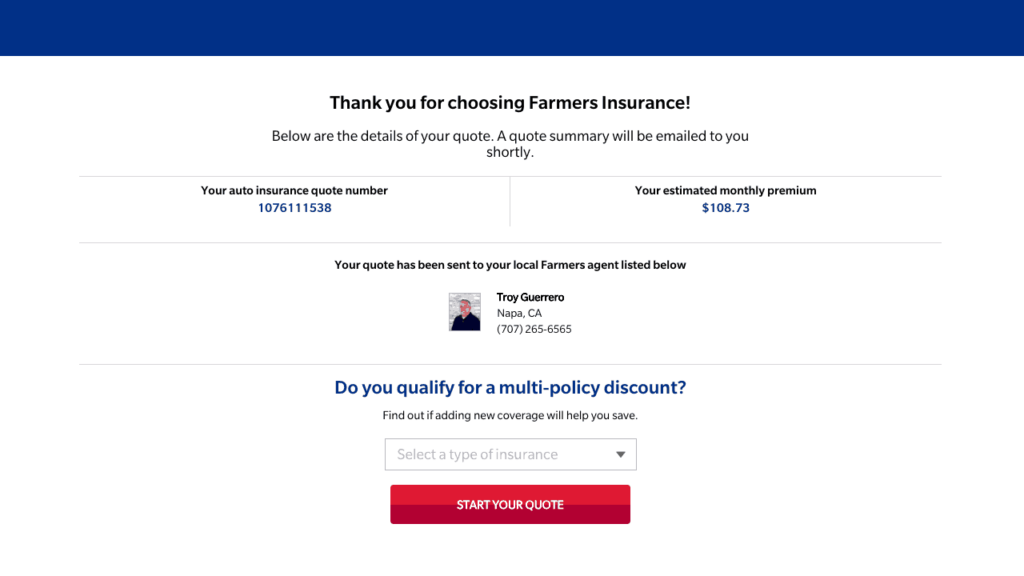

Respondents from our May rankings of the online car insurance market gave Farmers.com some of the lowest scores in the study for the customer experience themes Look & Feel, Product Offer, and Brand. The quote proposal page Farmers.com presents after they’ve received the personal information of drivers sums up why.

The driver has just spent ten minutes monotonously providing information and all they get from Farmers.com in return is the uninspiring page you see above. Instead of giving the driver exactly what they came for right away, Farmers.com chooses to provide the details in a separate email that will be sent “shortly,” which means the driver has to take another step before getting what they want. That’s not rewarding the customer. Yes, the driver gets an estimate of what their monthly premium would be, but there’s no explanation as to how Farmers calculated that number nor an explanation of what that premium will cover. The page also informs the customer that their quote has been sent “to your local Farmers agent listed below,” but only a phone number is listed underneath. Other insurance companies like StateFarm.com actually show a local agent with a photo and name once the quote-getting process is finished, which works to personify the brand. Overall, if your business is providing people with insurance, our data tells us there are far better ways to present your product than what we see above.

>>> Download the insights report for the US Car Insurance benchmark and ranking.

What you should do

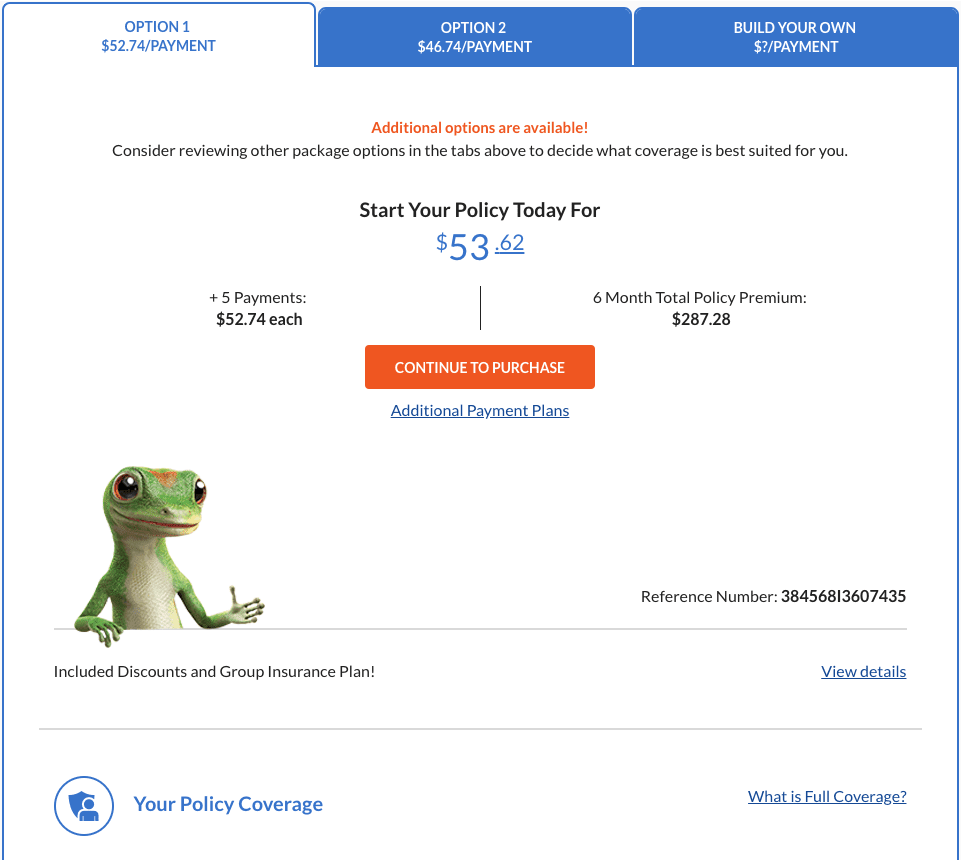

Where Farmers.com fails to reward customers for their efforts, GEICO.com does the opposite. The car insurance company not only provides an attractive looking page, but also gives drivers multiple options to choose from. Shall we have a gander at the screenshots below?

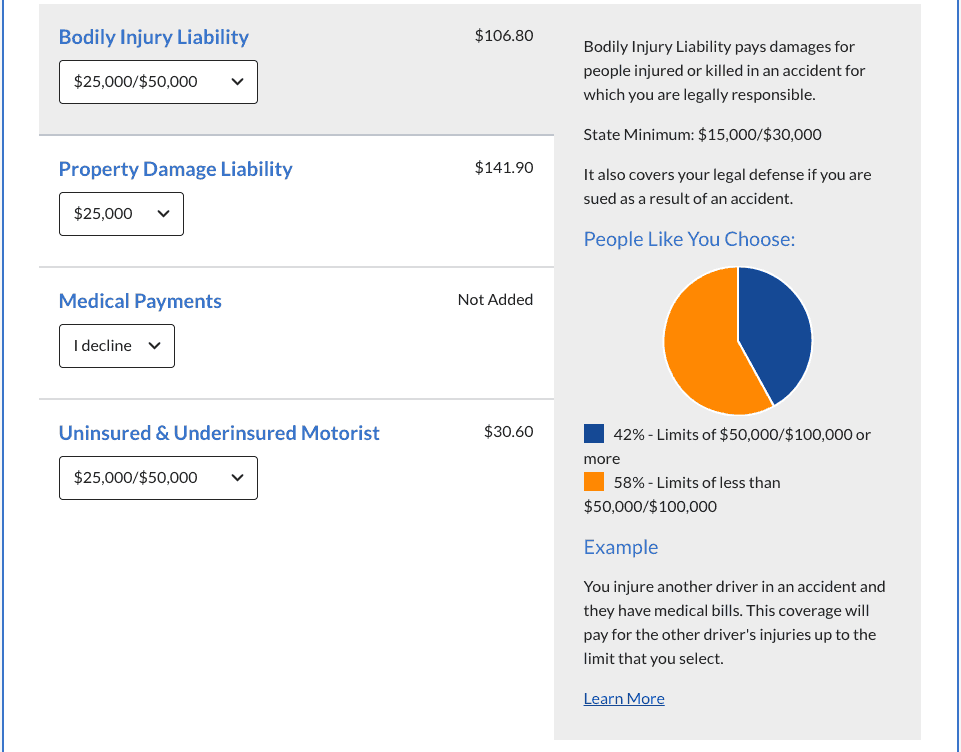

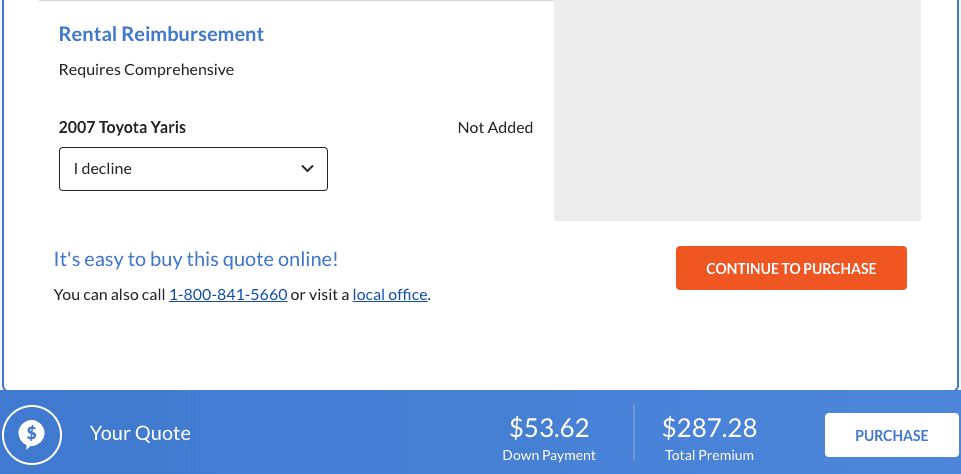

With an intriguing color scheme, multiple policy options to choose from, an explanation of the costs and examples of scenarios in which the car insurance policy will cover you, this page has it all. Drivers can even custom-build their own policy if they want to and are provided different payment options. What a page like this tells customers is that this brand is flexible and will do anything to create a package that suits their needs. GEICO.com also carefully details the significance of every aspect of the package. For example, should you be an accident in which someone is injured and you are legally responsible, GEICO explains that the package will cover your “legal defense if you are sued as a result of the accident.” These texts work to create a feeling of transparency and helps to explain why GEICO scored highest in our study for the categories “Trust in company” and “Company will deliver on promises”. This is also a textbook example of communicating brand through web design. Lastly, much unlike Farmers.com, the gecko-loving insurance company allows drivers to buy the insurance online immediately if they so choose.

What have we learned?

It’s simple. If customers are going to spend time filling in personal information, provide them with the information they are seeking immediately. Present it to them in a neat, detailed, and orderly fashion, and they will be more likely to bestow their trust in your company. Considering that Geico.com was ranked highest in our latest benchmark study of the online car insurance market, it seems it pays off to provide the details of their premium right away.