What home insurance companies can learn from StateFarm.com

When you sign up for a home insurance policy, you’re not just choosing the company that will cover your home in case the unthinkable happens. What you’re really doing is entrusting a company with your most valuable asset. Homeowners need to have a sense of confidence in the insurance company they elect for, and with more and more people going online to sign up for insurance, it’s vital for home insurance companies to be able to communicate the reliability of their brand on the Internet.

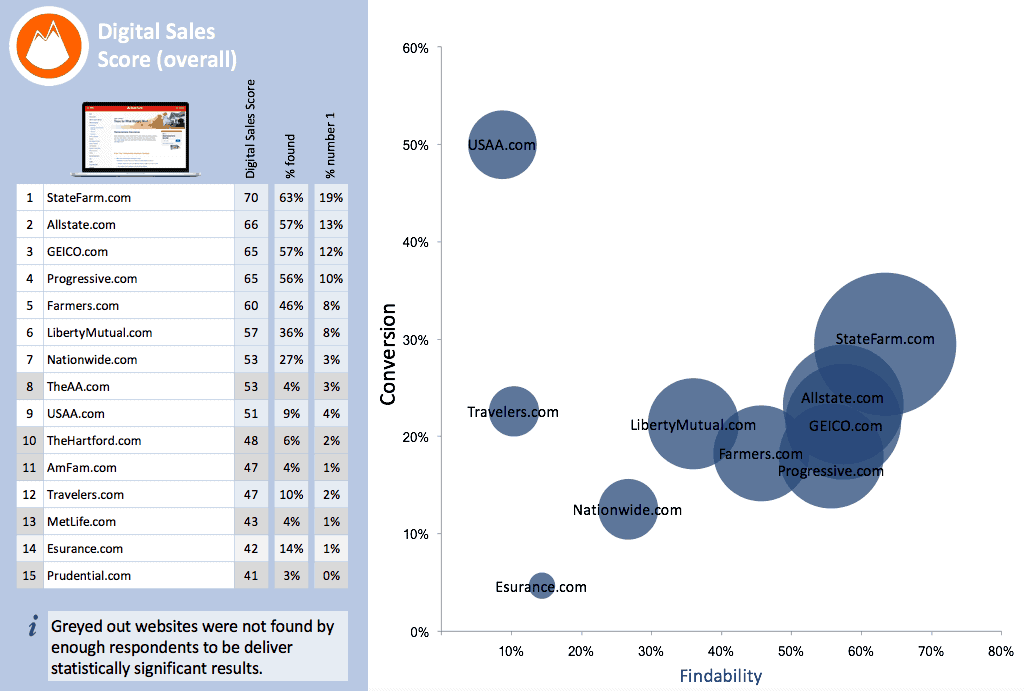

In our latest WUA Digital Sales Scan, we measured the online US home insurance market to find out what the best practices are for companies trying to sign up homeowners. The 300 respondents featured in our study evaluated 15 different online home insurance companies. Out of those 15, StateFarm.com emerged as the clear winner for providing the best online customer experience. Here are a few of the best practices that the competition can learn from StateFarm.com.

Being easy to find is crucial in a crowded market

The Internet is a massive forest of information, and consumers must maneuver through the thick brush to get to the tree they want. However, if a company plants their tree near the entrance of the forest, chances are the consumer will choose that one instead of diving deeper into the woods. From the results of our study, we can see a strong correlation between findability and customer preference. The quintet of companies that received the highest digital sales scores were also the five companies that respondents found the most.

From the graph above we can see StateFarm.com had a conversion rate of 29%.

StateFarm has a strong presence on the web, with 63% of respondents coming across the company website in their search for house insurance. The insurance giant already has a strong brand that people can recognize, but it also winds up at the top of search engine results regularly, which, as this study shows, pays off with high user traffic. Investing in paid search marketing is one way to get your company at the top of search engine results. This may seem like a luxury, but it can truly increase the number of people visiting your site and deliver paying customers, who bring in revenue to offset that investment in findability.

First impressions are everything

Findability isn’t the only thing that differentiates StateFarm from its competitors. A look at the numbers shows us that of the 63% of respondents who found StateFarm, 19% selected it as their preferred company for home insurance. Such a high conversion rate is unmatched in this Digital Sales Scan, with the next best company, Allstate, finishing with a conversion rate of 13%. One of the main aspects that respondents applauded was the first impression that StateFarm.com gives to potential customers.

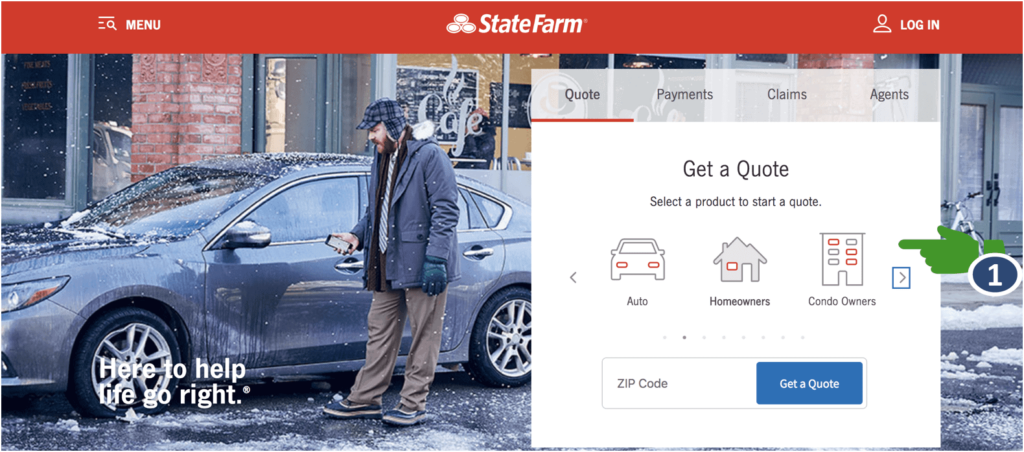

As the green arrow points out, the homepage features clear icons and an easy entrypoint into the quote-getting process.

“Simple,” “Informative,” “Quick,” and “Easy to navigate,” these are just a few of the comments that respondents left behind after arriving to StateFarm.com. One respondent even wrote “I don’t feeling like they’re trying to sell to me, but rather, they’re trying to teach me.” A response like this tells us StateFarm is doing a job of communicating a sense of trust to potential customers. The homepage of the website is clean, allowing customers to scroll down and see the main aspects that come with a StateFarm insurance plan. The website also makes use of icons to easily guide customers to the page that they need to go to. These are some of the factors that got StateFarm a score of 81 for first impression, and also helps to explain why 52% of respondents continued navigating the website after their initial arrival.

Getting a quote should be quick and easy

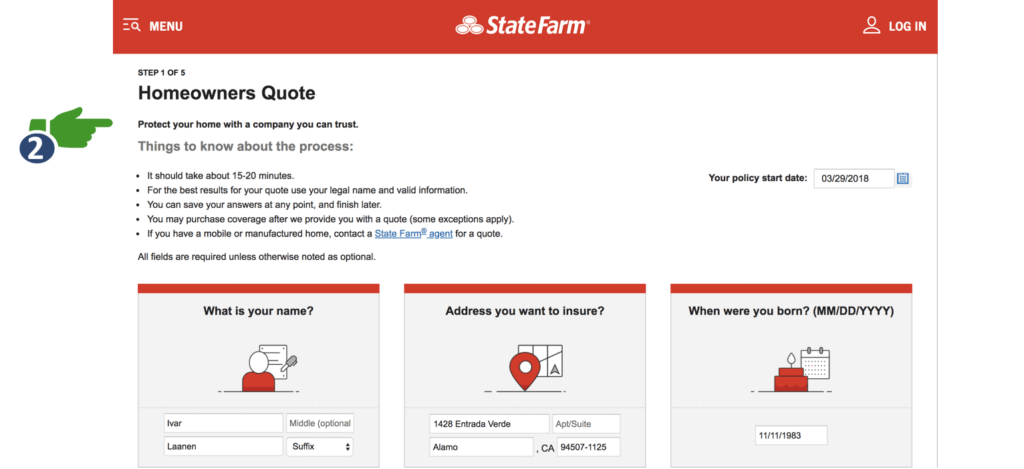

When we measured the online car insurance market in January, respondents raved about the clear overview that StateFarm.com provides when signing up for a quote. In similar fashion, respondents were very pleased with the quote-getting process for home insurance.

StateFarm sets expectations for potential customers looking to get a quote.

StateFarm.com tells customers exactly what to expect when getting a quote. The website uses bullet points to explain how long the process will take, how to get the best results, and how to contact the company in case of questions. It even allows customers to save answers at any point so that they can come back and finish the job later. As respondents fill in information, the website also shows how much progress they are making. By making the process of getting a quote quick and easy, StateFarm.com was able to achieve a score of 85 for the category Look & Feel.

WUA’s Digital Sales Scan

The WUA Digital Sales Scan allows us to find the elements of a website that work best to attract customers. This article on the best practices from the online home insurance market provides a sampling of fantastic insights that other companies can utilize to enhance the online customer journey, but our data provides an even better idea of how to achieve digital excellence online. Do you want to become a leader in digital sales? Our digital experts can help your company become that by creating a custom tailor-made report based on data to improve the customer journey step-by-step.

Each Digital Sales Scan report includes market best practices both inside and outside your industry, recommendations and customer feedback on each step of the customer journey, and screenshot analysis to help your team create a better website and drive conversion. Read more about the Digital Sales Scan here.