What you can learn from the fastest climbers in the Dutch health insurance market: Part 2

In Part 1 we introduced you to four very fast climbers in the health insurance market based on the desktop health insurance orientation study from November 2015 in The Netherlands: Menzis.nl, CZ.nl, DeFriesland.nl, and Univé.nl. We explained why these four providers are doing so well in various parts of the WUA! Digital Sales Scan research model. We discussed the topics of Findability, Look&Feel, and Offerings.

The fast climbers in the health insurance market

If we compare the absolute scores of the November 2015 measurement to those of the November 2014 measurements on the desktop, the four providers ranked by increase in DSS score are as follows:

2. DeFriesland.nl: +10 (van positie 16 –> 10)

3. CZ.nl: +7 (van positie 3 –> 1)

4. Menzis.nl: +7 (van positie 5 –> 2)

In this second part, we will tell you more about the desktop performance of the four fast climbers in the last two parts of the Digital Sales Scan research model: Brand, and Ordering Process.

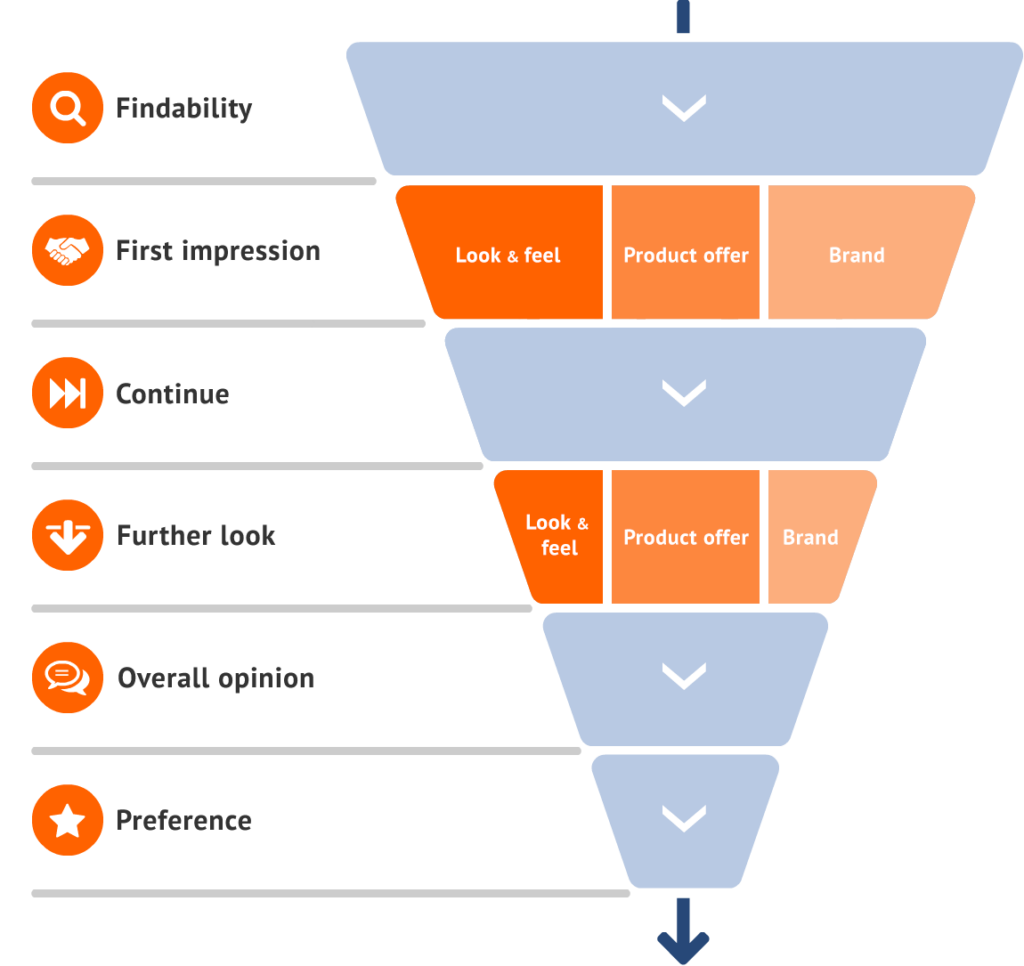

The WUA! Digital Sales Scan Model

Topic: Brand

First impression

Respondents who formed a first impression of the Brand, gave DeFriesland.nl first place in this study. Since this healthcare provider was number 18 in last year’s measurements on the desktop, we can state that DeFriesland.nl has taken a giant leap in the rankings!

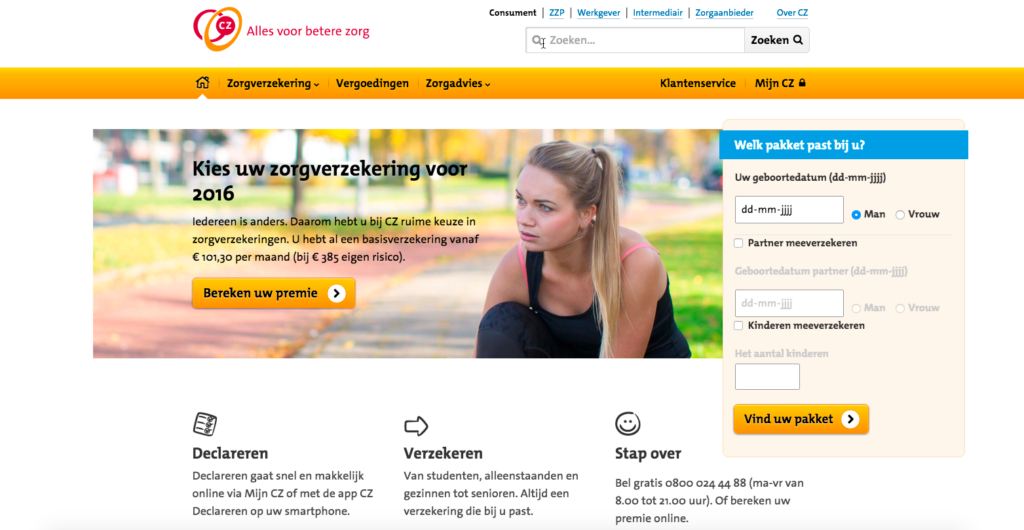

CZ.nl is also following this trend, given the rise from 9th to 4th place. CZ.nl remains behind DeFriesland.nl by two points. Univé.nl follows on 7th place and gained no less than nine places (16th last year). Menzis.nl performs slightly less well compared to the other three fast climbers: last year came 5th, and this year the insurer drops one place to number 6. They do this with an unchanged absolute score of 73 points.

Where does the good first impression come from?

DeFriesland.nl largely owes its high position on first impression to the professionalism and expertise that respondents are awarding the company with. One respondent puts it as follows: “Easily accessible, generally good benefits, clear explanations”. CZ.nl also gets high scores in these areas. Interestingly, the contribution rate also appears to influence the respondents’ brand perception, as evidenced by this quote: “500 million of their reserves were used to slow down the rise3 of their premium”. When respondents were asked which health insurer they found the most likeable, DSW.nl is performing slightly better than DeFriesland.nl. With DSW.nl, people feel like they’re dealing with a very sincere and transparent health insurer: “It is a small company with an ideology that appeals to me. They are very transparent.”

Deepening

During the deepening phase on the topic of Brand, it is once again DeFriesland.nl taking the largest leap by gaining 20 places (22nd to 2nd). Univé.nl goes from 12th place to 7th place (gaining 5 places). CZ.nl (7th 6th) and Menzis.nl (9th 8th) both gained one place in the ranking.

When going deeper, mainly the contact options play an important role: how easy is it to make contact with a health insurer? Are the contact options pleasant? Additionally, service expectation, confidence, and faith in the promises made by a company play an important role.

The four fast climbers get high scores on all of these aspects. With DeFriesland.nl, this is evident when respondents are asked about the expected service and the ease with which one can get in touch with the health insurer: “Many different ways to connect, company tries to remain close to the customer by showing the picture of someone at customer service.”

Topic: Ordering Process

The ordering process is not part of the Web Performance Score in the WUA! research model. That’s because the respondents have already made their choice after giving an overall judgment on the basis of their findings on the topics of Look&Feel, Offerings, and Brand. Still, the ordering process is crucial in the customer journey: it determines how easily people get to the actual application for health insurance. If we express this ease in figures, we get to the word conversion, which is crucial for the performance of websites. That is why the ordering process is in fact included in the survey, and will be assessed separately.

Univé.nl takes the biggest leap of the four fast climbers, rising from 19th place last year to 10th place this year. CZ.nl gains five places (11th 6th) in the rankings. Menzis.nl manages to rise from 13th to 11th place. Only DeFriesland.nl has a minor setback: the health insurance company in Friesland drops five places, from 2nd to 7th place. It is important to note here that the scores from all providers are very close to one another. The scores between the number one (81 points) and number ten (77 points) are just four points apart. That means that losing or gaining one point can quickly make a big difference in the ranking.

With Ordering Process, a nice and smooth process plays an important role. In addition, it is important that people are kept well informed during the process and that they have confidence in the proper handling of the request. Hoyhoy.nl and CZdirect.nl (number one and number three in this area) know how to get the hands of the respondents together by offering assistance throughout the ordering process in a visible place (through chat, phone, WhatsApp, e-mail and/or video chat) for consumers who are struggling.

Conclusion

It all starts with Findability. If a provider is not found, then respondents are unable to prefer the brand in question. Once an insurer is found often enough, then the topics of Look&Feel, Offerings, and Brand start to play and important role. The point of this health insurance orientation study is that information should be easy to read and presented in a concise manner (Look&Feel). The basic and supplementary insurance should not only be well-priced, the company should also be clear about what coverage they offer (Offerings). Furthermore, it is crucial that an insurer is easily accessible and exudes confidence (Brand). If all this is in order, and people are actually about to apply for a health insurance policy, then it’s all about an ordering process that is as pleasant and smooth as possible.

Do you want to score higher too next year in the WUA! Web Performance Scan? Would you like to learn more about the study and the results? Please do not hesitate to contact us!